A Guide to China Healthy and Nutrition Market in 2022

- SODA Global

- Apr 3, 2022

- 8 min read

Updated: Sep 27, 2022

How big is China healthy and nutrition supplement market

Market data for China healthy food industry

According to a new analysis by iiMedia Research, China's health supplement industry grew from RMB128.2 billion in 2015 to RMB222.7 billion in 2019 (US$35.3 billion), making it the world's second-largest consumer of health care products. The health goods market in China is expected to reach RMB328.3 billion ($52.0 billion) in 2023, according to industry estimates. Consumers' propensity to purchase health items has undergone a dramatic shift.

In the 1980s, the Chinese health food industry began to take root. In addition to a well-balanced diet, "health foods" are defined by the National Food Safety Standard as foods that claim to have specific health functions or vitamin, supplement, and mineral intakes. A wide variety of ages can benefit from these meals, but they do not treat or prevent disease.

Since China's economy is more open to overseas countries, the country has become the world's largest market in practically every product category. As a result of the rapid growth of the cutting-edge retail high tech market in China, it is currently considered a leading indicator of change in growing markets and countries.

Chinese Consumers of healthy product

Imported and functional healthcare goods have been increasingly popular with younger consumers. A recent study by Tmall Global shows that the post-85s and post-90s generations, as well as the post-95s generation, are increasingly using and accepting health care items.

Spending on imported health supplements has increased 51 percent YoY during the 1990s, when the epidemic began. There has been an increase in people's understanding of the benefits of consuming supplements to maintain a healthy diet, immune system and digestive system as well as to improve sleep and concentrate. Many people in China's first-tier cities have developed symptoms of "health anxiety" as a result of their fast-paced way of life and excessive work hours (996).

What most popular healthy supplements in China?

People still buy health supplements in the form of pills, powder, granules, and liquids. It's important to point out that the gummy type has a lot of growth recently. In the category of health foods, some newer brands like Olly and Unichi are making chewables and gummies popular. They are both from the United States and come in a variety of flavors. They've done this by making their "bear gummies" stand out and not using traditional capsules, which has made them popular with the younger generation. This has helped them grow quickly in the China market.

Niche 1: Improve sleeping oriented nutrition products

Many young people find it difficult to wind down at night due to a lifestyle that includes late nights at work and early mornings at school.

Product categories that address hair loss, weight loss, and sleep deprivation remain popular in Alibaba's 2021 Tmall Healthcare Trend Report. This year has a 220 percent increase in selling of sleep aids like pills, patches, and other electronic gadgets. In light of China's reputation for grueling work conditions, this contributes to a growing reaction.

Niche 2: Sport and fitness nutrition

The sports nutrition industry in China is a small but rapidly growing component of China's overall health food business, despite the fact that China's fitness and health market is rising at an unprecedented rate. Eighty percent of sports nutrition products that are sold through internet channels. Euromonitor estimates that the Chinese market for sports nutrition products has grown to RMB 15.1 billion.

Foreign companies were the initial players to market with products in this sector and have gone on to dominate the industry. One of the most well-known and best-selling brands is Muscle Tech, which is now controlled by Xiwang Food.

Top sport nutrition global brands in China includes Herbalife, Amway, Puritan's Pride, Orgain, GNC, NOW, Myprotein, Nature's Way, Sports Research, PipingRock, Naturade...

Niche 3: Beauty nutrition

In 2020, annual sales of "Beauty from inside" items increased by 100% year-over-year, according to Alibaba Health's Chinese Women's Health Consumption Report 2021.

Women of different ages, on the other hand, have varying health product requirements. In the post-00s, people are increasingly worried with their appearance. Health management is becoming more popular among women born after 1990, who prefer scientifically produced probiotics. The post-80s are concerned with maintaining healthy skin plus anti-aging products together. Collagen beverages, sleep aids, and biotin pills for hair loss are among their most popular offerings.

Niche 4: Infant nutrition

The market for mom and baby health foods is predicted to grow as the three-child policy is implemented across the country. Pregnant women, according to research, consume 94,7% of the recommended daily allowance of fruits and vegetables. There are a number of popular options, including milk powder, folic acid, and multi-vitamin tablets. Over RMB60 billion will be spent on maternal and newborn health food in 2020, according to a iiMedia Research estimate, and the industry is expected to reach RMB70 billion by 2021. Products that have been approved by the government or fulfill national nutrient criteria are preferred by more than 70% of pregnant and breastfeeding women and their families.

Niche 5: Daily nutrition

Young people have a lot options on their plate, so they eat healthy food to make up for it. Brands from both inside and outside China need to tell Chinese people about their product offerings and how they would help them in their busy lives. The market for health supplements in China is growing quickly, but it's also one of the most complicated and profitable businesses in the world. This is because there are so many different types of people who live in different cities.

The 'Daily Nutrition' weight can show that Chinese people are becoming more interested in healthy living. Kantar says that people are very interested in supplements that help their immune systems, like vitamins, calcium, protein, and probiotics.

Alibaba Health also found that there has been a 56% rise in nutritious foods that can be eaten on the go, like sesame balls, bird's nests, and goji-berry drinks. The report said that their popularity was part of the "fragmented healthcare" trend, which means that more and more Chinese people are searching for commodities or treatment options to manage their own health in their free time.

Competition in China healthy and nutrition food market

According to the World Health Organization (WHO), China has 2.2 million health food production firms, with Shandong and Guangdong accounting for more than 490,000.

The vast market potential and development chances in China’s health food business should not only inspire more participants in the pharma companies and milk powder sector to reform, but also allow some of these enterprises the possibility to break out of their existing condition. These corporations have an advantage in the healthy food industry because of their current R&D, manufacturing, and marketing skills, as well as client bases.

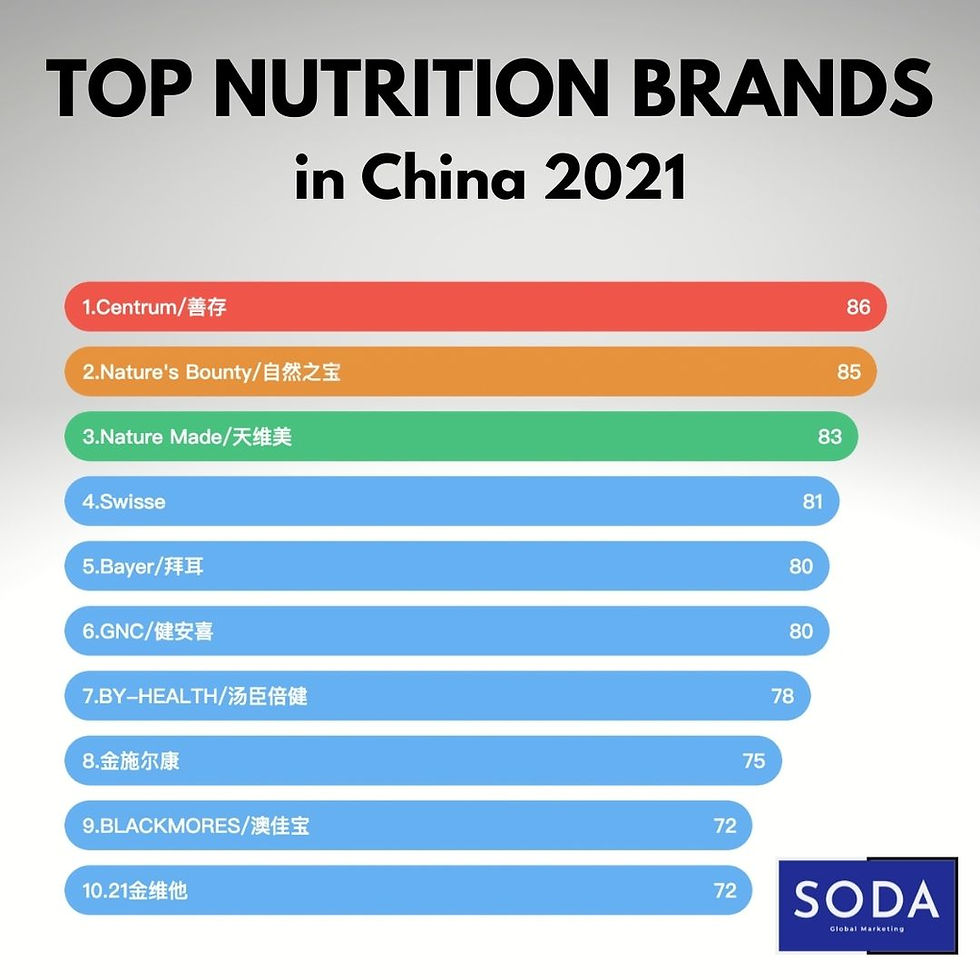

In October 2021, 2,605 international brands were functioning in China's marketplace. Centrum, Nature's Bountry, Nature Made, GNC, Life Space, Blackmores, Move Free, and Swisse are the top global health food and supplement brands.

According to sales data from November 2021, Swisse generated RMB 266 million (£31 million). Top items from the company include supplement complexes geared toward particular consumer groups, such as pregnant women and the elderly.. During the Double 11 sales, Swisse's GMV increased by double digits, and the company maintained its top rank on multiple e-commerce platforms.

To be successful in China, the above-mentioned businesses worked hard to get an understanding of Chinese consumers, honed their products and marketing strategies to meet those needs, and created new consumer categories based on their findings. They've developed solid working ties with major distribution and sales partners, as well as with the media and their own customers' key influencers (KOLs). They've also been able to hold on to their top spots in their home nations, which has helped to increase customer confidence.

Consumers are more willing to buy from trusted international brands

Nearly 60% of the participants in a research by the Chinese Nutrition Society stated that they had previously purchased imported supplements. They use the country of origin to determine the legitimacy of imported goods.

The most popular health supplements in China are made in countries like Australia, New Zealand, Canada, and the United States.

More than that, e-share commerce's of the health industry has nearly tripled in the past year to nearly 30%. A projected 200 million cross-border consumers in China are expected by 2021, and online cross-border consumption is gradually now becoming popular destination for imported health supplements.

Tmall Global and JD Worldwide, two of the most successful cross-border e-commerce platforms in China, are the key sales avenues for multinational DTC brands to enter the Chinese market.

Nutrition healthy brand strategy in China

Important import policy to China

Brands need to clearly understand the policy from China government if plan to export to China.From Jan.2022, all food and supplements which need to export to China, they need to register in China custom, special dietary foods and dietary supplements need to have recommendation or certification from official authority organisation in original countries before register in China custom system.

Sales channels

Marketing in the healthy food industry is still heavily influenced by the use of traditional methods. The features of a product are used in traditional marketing to define distribution channels and sales techniques. Shopping malls and hypermarkets are the primary sales channels for general nutritional or gift-type products, while the Chinese New Year and festival holidays are the most important promotional and sales periods.

The e-commerce market share for health food sales is roughly 30 percent. Online retailers save money by not having to pay for physical storefronts, which allows them to offer things at reduced prices. Now that reliable pharmaceutical e-commerce platforms are available, people have more options when it comes to purchasing their medications online. Health food sales on Alibaba's platforms, for example, increased by 56% year-on-year in 2020 to RMB33.4 billion. Sales surged 63.3 percent year-on-year to RMB6.21 billion during the Double 11 China ecommerce promotion period.

Physical stores were forced to close as a result of the epidemic, while e-commerce platforms saw an increase in page views as a result of more time spent at home. About 50% of the internet sales of health supplements will be made by people born after the 1990s and after the year 2021, according to the Ebrun Research Institute's white paper on digital development of emerging businesses.

How other nutrition Brand Strategy is working

The five largest Chinese e-commerce platforms — Tmall, JD.com, Kaola.com, VIP.com, and Xiahongshu — all have strategic ties with brands like Swisse. As a result, they have formed retail trading relationships with other companies. Even among younger generations, Douyin (China's counterpart of TikTok) is becoming extremely popular as a shopping online destination, especially among Gen Z. During the 2021 618 shopping season, Swisse's GMV on Douyin grew by 316 percent.

Among the best-selling brands on Tmall during the Double 11 period this year were Chinese natural foods brands like By-Health, Simeitol, and Keylid. For the third year in a row, By-Health has topped the sales statistics for vitamins and nutritional supplements on both JD.com and Alibaba.com. It made RMB 600 million in revenue and grew by 38.3% year-on-year.

In addition, By-Health has a global line of 10 to 15 items, all of which are made in the United States or Australia. Milk thistle was the company's best-selling item during the Double 11 celebration, as was its recently debuted melatonin product, which was a hit with Chinese shoppers. Sleep Pro, the company's second-best-selling product this season, was just released in the mid of the year 2021. The company noticed that the type of consumer that decides to acquire milk poppy usually works long hours, is motivated to protect their liver and tend to encounter troubles with sleep. As a result, the business discovered that customers who bought Sleep Pro also bought milk thistle.

Top important nutrition exhibition

More than 500 exhibitors from 36 countries and 32 Chinese areas are expected to attend the China Beijing and Shanghai International Nutrition and Health Industry Expo this year. Health food, nutritional food, functional food, fun foodstuffs, health drinks, slimming beauty products, cosmetic raw materials, pharmaceutical raw materials, medical supplies, and healthcare products are only a few examples of the diverse topics covered by the exhibitors.

The 22th China (Guangzhou) International Nutrition Healthy Food and Organic Products Exhibition 2022, June 16-18,2022

At the same time, the China (Guangzhou) International Nutrition &Health Food and Organic Products Exhibition (CINHOE) is taking place (IHE China). Over 1,500 brands from 45 countries will be in attendance at this massive convention.

In conclusion from SODA Global Marketing

For healthy&nutrition brands, if you already have good sales on your local country and plan to invest new market, China will be your top priority. You can see the big trend for this industry in China, consumers are very strong to purchase international brands.

Before decision, one right brand strategy is the first step.

SODA Global Marketing expert can help you to make one reasonable Go-to-market strategy to help you brands to create right brand assets in Chinese, digital marketing strategy and sales strategy, avoid all legal risk and develop the business smoothly in China.

Comments